|

|

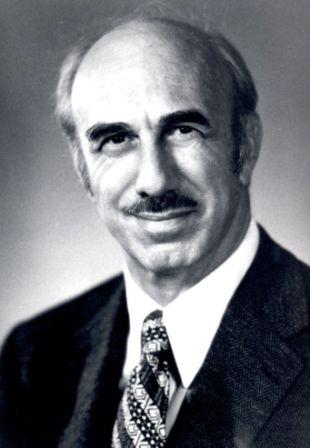

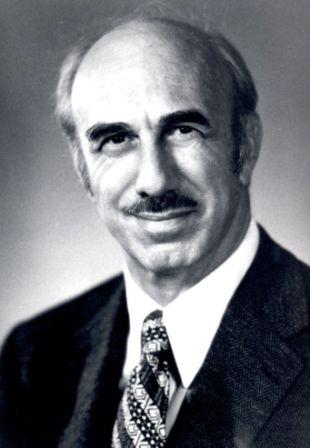

IN MEMORIAM

Sherman J. Maisel

Professor of Business Administration, Emeritus

UC Berkeley

1918—2010

Sherman J. Maisel, professor emeritus of the University of California, Berkeley’s Haas School of Business, and a former member of the board of governors of the Federal Reserve System, died from respiratory failure on September 29, 2010, in San Francisco, California. He was 92. Sherm, as his friends always knew him, had a huge influence on the Berkeley campus as a professor, as the director of a major campus research unit, and as a prolific researcher and writer. Outside the University, he was perhaps best known for his role in shaping the modern structure of the U.S. mortgage market while on leave from Berkeley as a governor of the Federal Reserve System in Washington, D.C.

Sherm was born in Buffalo, New York, on July 8, 1918. He received four degrees from Harvard University, including an A.B. (1939) and a Ph.D. in economics (1949). From 1939 to 1941, he worked as a research economist at the Federal Reserve Board in Washington, D.C. He served in the U.S. Army from 1941 until 1945, rising from private to captain and serving as an ordnance officer at U.S. air bases and ordnance depots. He also served one year in the U.S. Foreign Service in Brussels, Belgium.

As a young man in the 1940s, Sherm was struck by the loss of income and great distress caused by the fluctuations in home building he witnessed. As a result, he devoted much of his career to studying the housing and mortgage markets and developing monetary policies that would smooth the severity of the industry’s cycles.

In 1948, Sherm joined the faculty of the School of Business (now Haas School of Business) at the University of California, Berkeley, where he helped found the Center for Real Estate and Urban Economics — one of the first research centers in the country dedicated to the field. He took leave from UC Berkeley in 1965, when President Lyndon B. Johnson appointed him to the board of governors of the Federal Reserve System. He returned to the business school in 1972. In 1986, he retired as California State Professor of Real Estate and Urban Economics and was awarded the Berkeley Citation for distinguished achievement. Until just the week before he passed, Sherm could still be found on most Fridays at The Faculty Club, where he was a key member of the “Little Thinkers, ” a group of emeritus professors who met weekly for lunch and discussions.

Sherm’s research on monetary policy, housing, the mortgage market, and economic forecasting has been published in 14 books and more than 100 academic articles, including “Determinants of Residential Construction,” “Impact of Monetary Policy” for the Commission on Money and Credit, and “Financing Real Estate” (1965). He also contributed to the first large-scale computer model of the U.S. economy, the Brookings Model, in 1965.

His work showed that changes in the mortgage market and the long lags in the building process were primary sources of the large volatility in housing starts and construction activity that imposed high costs on the U.S. macroeconomy. At least until the 1970s, mortgages in the U.S. remained primarily a local product, dependent upon the uneven flow of deposits into savings and loan institutions and banks. To make matters worse, the government mortgage programs had a cyclical bias that suppressed home construction during recessions because their fixed rates lagged behind changes in the major credit markets.

Sherm’s research on housing cycles and mortgage markets was the state of the art. His many papers on monetary policy and housing markets form the foundation of current housing finance research. His textbook Real Estate Finance was used by a generation of real estate finance students around the country.

President Johnson drew on Sherm’s mortgage expertise when he nominated him to the Federal Reserve Board in 1965. While a member of the “Fed,” Sherm was appointed by the president to a White House task force to reconcile the large regional imbalances in the mortgage market: while lending and construction activity was shifting to the West Coast, the greater part of the loanable funds remained on the East Coast. Sherm was the architect of the task force proposals to allow the Government National Mortgage Association, also known as Ginnie Mae, to guarantee securities backed by pools of mortgages. It also proposed that the Federal National Mortgage Association, also known as Fannie Mae, become a government-sponsored agency. These entities proved fully successful in creating a unified national mortgage market for the United States.

In addition to his work on housing finance reform, Sherm chaired several internal committees of the Federal Reserve that made a number of critical recommendations to the Federal Open Market Committee. Their adoption led to significant improvements in the committee’s deliberations and decisions, particularly in better uses of available economic data and forecasts. Sherm’s book Managing the Dollar remains one of the few studies of the Fed’s operations based on a participant’s knowledge.

In addition to his academic work, Sherm was very active in the Berkeley community. From 1962 to 1965, he was a member of the Berkeley Unified School District Board of Education, where he led efforts to increase the funding, improve quality, and reduce what he and others on the board considered de facto segregation in the city’s schools. Sherm’s son, Lawrence Maisel, recalls, “In order to help pass a bond issue to finance the schools and, later, to win a special recall election brought by those objecting to redrawing school boundaries, he encouraged a campaign to register UC Berkeley students as voters in the city. Thanks to the new voters, plus get-out-the-vote drives on campus, Berkeley’s political landscape changed within five years from a very conservative one to the liberal one we know today.” The story is told that when Sherm first met President Johnson to discuss the pending nomination it was, to his surprise, not his views on monetary policy the president wanted to discuss. Instead Johnson was interested in the fact that Sherm had won the Berkeley School Board recall election, saying how important he thought it was to have faced the electorate in an active campaign.

Sherm was a fellow and past president of the American Finance Association. From 1972 to 1980, he also served on the senior research staff of the National Bureau of Economic Research and as a director of its West Coast office. From 1978 to 1980, he and his colleagues at the bureau conducted a detailed study of risk and capital adequacy in banks and savings institutions for the National Science Foundation and the government deposit institutions. Their report explained the danger to the deposit insurance funds of a concentration of risks, particularly from interest rate changes and also from too little attention to real, in contrast to book, net worth. They emphasized that dangerous moral hazards existed because banks and savings and loans could make risk-free bets against the insurance funds. The administration adopted policies exactly opposite those recommended, leading to the savings and loan crisis of 1985, causing billions of dollars of losses to the government.

Sherm met his wife, Lucy Cowdin, in 1939 in Washington, D.C. Both had been chosen to be among the first group of interns at the National Institute for Public Affairs, a program designed to attract recent college graduates to careers in government service. Among Maisel’s enthusiasms were bridge, golf, and travel. Says his daughter, Peggy Maisel, “My parents have traveled to almost every country in the world.”

Sherm is survived by his wife of 68 years, Lucy Cowdin Maisel; a son, Lawrence Maisel, of New York City; a daughter, Margaret (Peggy) Maisel, of Miami, Florida; and two grandchildren.

To view a video conversation between Ken Rosen and Sherman Maisel that was filmed in 2009, go to http://video.haas.berkeley.edu:24874/groups/OMT/ShermMaisel.mp4

A more complete biography of Sherman Maisel may be found in B. S. Katz, ed., Biographical Dictionary of the Board of Governors of the Federal Reserve (Greenwood Press, 1992).

Dwight Jaffee

Kenneth Rosen

2011